Indiana’s Medicaid Underpayment Creates a Hidden Health Care Tax on Hoosier Families and Businesses

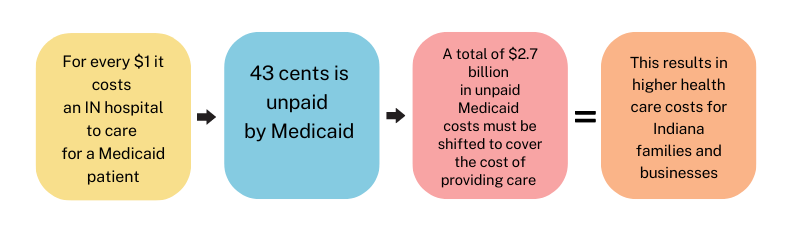

The Medicaid program is an essential program in Indiana, providing health care coverage to 2.2 million people, or nearly one in three Hoosiers. Despite the vital benefits of the program, Indiana Medicaid covers only 57% of the cost of providing care.

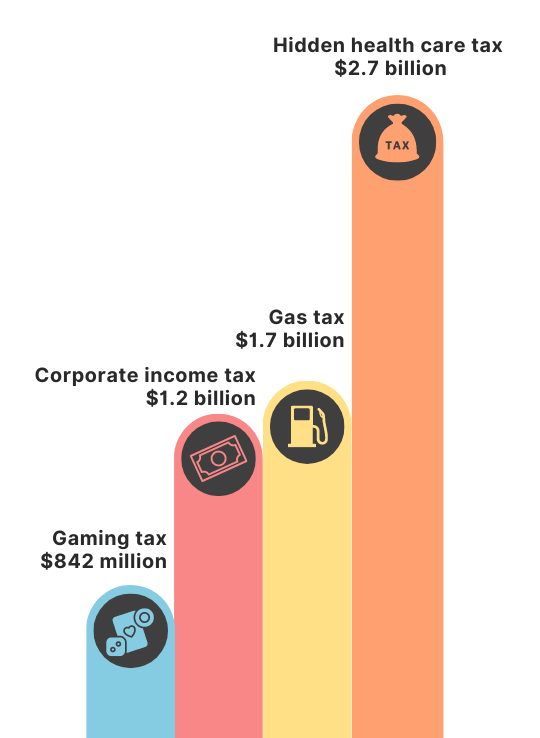

Indiana’s low Medicaid reimbursement results in as much as $2.7 billion in unpaid health care costs each year. These unpaid costs are shifted to Hoosier families and businesses, creating a Hidden Health Care Tax, which drives up health insurance premiums for all consumers.

Indiana’s Medicaid base rates paid to hospitals have not been increased in over 30 years. Appropriately funding hospitals’ Medicaid rates would reduce the cost-shifting burden on Hoosier families and businesses and cannot wait until the next state budget cycle.

Indiana’s Hidden Health Care Tax is greater than the taxes Hoosiers pay for gas ($1.7 billion), corporate income ($1.2 billion), or gaming ($842 million).

Indiana legislators could help to reduce this Hidden Health Care Tax by increasing Medicaid reimbursement for Indiana’s hospitals.